The insurance industry has been in a unique transition phase over the last couple of years. We are still experiencing tumultuous times into 2024: Insurance companies are removing themselves from certain states, tightening their requirements for new and existing clients, and restricting certain vehicle types.

What does that mean for rates?

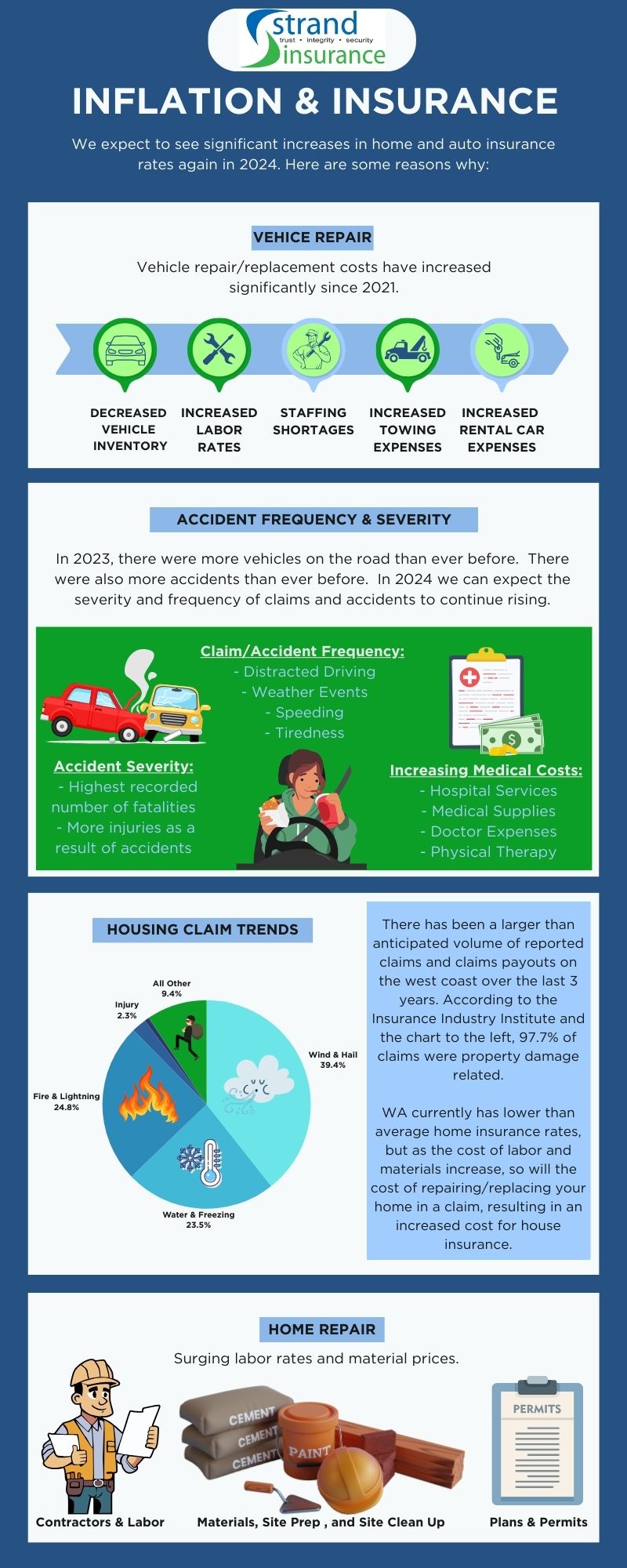

We can expect to see larger than normal rate increases. Here are a few reasons why:

- Increased theft, vandalism, and fire claims on Hyundai’s and Kia’s, so these vehicles are seeing larger than normal increases this year.

- Electric vehicles and Telsa’s are seeing larger than normal increases due to increased labor rates and inability to obtain parts.

- Inflationary increases due to the limited supply of vehicles, vehicle parts, increases in labor rates, and used car prices.

- In 2023, there was a 14% increase in medical related claims expenses due to injuries and fatalities in accidents. We expect 2024 to have an increase as well.